PRESS RELEASE

PRESS RELEASE

October 2021 euro area bank lending survey

26 October 2021

- Credit standards remained broadly unchanged for firms and tightened for housing loans

- Loan demand by firms and households continued to increase

- ECB’s monetary policy measures continue to support lending conditions and volumes

According to the October 2021 euro area bank lending survey (BLS), credit standards – i.e. banks’ internal guidelines or loan approval criteria – for loans or credit lines to enterprises remained broadly unchanged (net percentage of banks standing at 1%, see Chart 1) in the third quarter of 2021. Regarding loans to households for house purchase, euro area banks reported a net tightening of credit standards (net percentage of 8%), while credit standards for consumer credit and other lending to households also remained broadly unchanged (net percentage of -1%). Banks referred to risk perceptions related to the improved economic outlook as having a net easing impact on credit standards for loans to firms and households. Banks’ risk tolerance and their cost of funds and balance sheet situation had a neutral impact for loans to firms and consumer credit, while banks reported a net tightening impact of these factors for housing loans. In the fourth quarter of 2021, banks expect credit standards to tighten for loans to firms and housing loans, and to ease slightly for consumer credit.

Banks’ overall terms and conditions – i.e. the actual terms and conditions agreed in loan contracts –eased slightly, on balance, for loans to firms, while they tightened for housing loans and remained broadly unchanged for consumer credit in the third quarter of 2021. For margins on average loans, banks continued to report a narrowing in net terms across loan categories. Margins on riskier loans also narrowed for housing loans but widened for firms and remained unchanged for consumer credit.

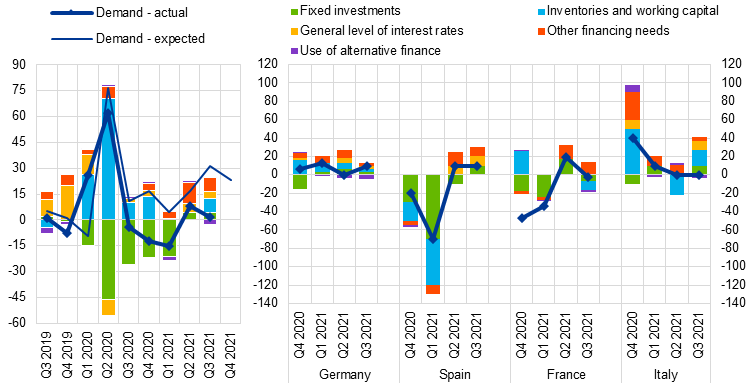

Banks reported, on balance, a slight increase in firms’ demand for loans or drawing of credit lines in the third quarter of 2021 (see Chart 2). Financing needs for fixed investment contributed positively to loan demand for the second consecutive quarter. In addition, loan demand was supported by firms’ financing needs for inventories and working capital, mergers and acquisitions and debt refinancing and restructuring, as well as the low general level of interest rates. At the same time, banks reported on balance that firms’ access to internal and alternative external financing sources had a negative impact on loan demand. Demand for housing loans and for consumer credit and other lending to households increased in net terms in the third quarter of 2021, supported by improved consumer confidence and the low general level of interest rates. In addition, housing market prospects contributed positively to demand for housing loans and increased spending on durables contributed positively to demand for consumer credit. In the fourth quarter of 2021, banks expect net demand to increase further for loans to firms and households.

Euro area banks’ access to retail and wholesale funding continued to improve in the third quarter of 2021, according to the banks surveyed. In addition, banks reported that the ECB’s asset purchase programme (APP), the pandemic emergency purchase programme (PEPP) and the third series of targeted longer-term refinancing operations (TLTRO III) continued to have a positive impact on their liquidity positions and market financing conditions. At the same time, banks indicated that the ECB’s asset purchases and the negative deposit facility rate (DFR) had a negative impact on their profitability, mainly owing to their impact on net interest income. However, this was mitigated by the ECB’s two-tier system for remunerating excess liquidity holdings and the TLTRO III programme. Asset purchases and the negative DFR had a net easing impact on lending conditions and a positive impact on lending volumes, mainly for loans to firms. Finally, banks reported that TLTRO III had a net easing impact on terms and conditions and a positive impact on lending volumes across all loan categories.

The euro area bank lending survey, which is conducted four times a year, was developed by the Eurosystem in order to improve its understanding of bank lending behaviour in the euro area. The results reported in the October 2021 survey relate to changes observed in the third quarter of 2021 and expected changes in the fourth quarter of 2021, unless otherwise indicated. The October 2021 survey round was conducted between 20 September and 5 October 2021. A total of 146 banks were surveyed in this round, with a response rate of 100%.

For media queries, please contact Silvia Margiocco, tel.: +49 69 1344 6619.

Notes

- A report on this survey round is available on the ECB’s website. A copy of the questionnaire, a glossary of BLS terms and a BLS user guide with information on the BLS series keys can be found on the same web page.

- The euro area and national data series are available on the ECB’s Statistical Data Warehouse. National results, as published by the respective national central banks, can be obtained via the ECB’s website.

- For more detailed information on the bank lending survey, see Köhler-Ulbrich, P., Hempell, H. and Scopel, S., “The euro area bank lending survey”, Occasional Paper Series, No 179, ECB, 2016.

Chart 1

Changes in credit standards for loans or credit lines to enterprises, and contributing factors

(net percentages of banks reporting a tightening of credit standards, and contributing factors)

Chart 2

Changes in demand for loans or credit lines to enterprises, and contributing factors

(net percentages of banks reporting an increase in demand, and contributing factors)

https://www.ecb.europa.eu/press/pr/date/2021/html/ecb.pr211026~fce9ee40ee.en.html

Read the survey: https://www.ecb.europa.eu/stats/ecb_surveys/bank_lending_survey/html/ecb.blssurvey2021q3~57cc722cfb.en.html